Addressing the Transformations in Networking Industry

Manoj Chugh, President - Enterprise Business, Tech Mahindra | Friday, 15 September 2017, 10:02 IST

Growth in the networking industry has been dramatic by virtually any measure, and despite some reports of a slowdown, we still expect to see growth in 2017. True, simple innovations such as advanced wearables may take a few years to emerge, and more complex ones, such as fully autonomous vehicles, are farther out. But one thing is undeniable: penetration and use across the ecosystem continues to increase in many key categories.

Growth in the networking industry has been dramatic by virtually any measure, and despite some reports of a slowdown, we still expect to see growth in 2017. True, simple innovations such as advanced wearables may take a few years to emerge, and more complex ones, such as fully autonomous vehicles, are farther out. But one thing is undeniable: penetration and use across the ecosystem continues to increase in many key categories.

Smartphone sales are still strong, with penetration up 10 percent YoY, and the highest growth percentage coming in the 45-54 and 55+ age demographics— groups that have previously lagged behind younger consumers.

While they are still relatively niche products, wearables such as smart watches and fitness bands have seen tremendous percentage growth. Smartwatch penetration doubled from 2014 to 2015 and tripled in 2016; smart watches have now penetrated roughly 12 percent of the mobile consumer market in the US and catching up the pace in APAC market with introduction of many small scale product enterprises.

However, in 2017 we may see a shift toward areas with a higher growth potential that go well beyond carriers’ core connectivity business.

Two potential areas of focus are content and the Internet of Things (IoT). The long-standing promise of delivering content to any screen is finally becoming a reality, enabled by advances in network technology and higher speeds, as well as enhanced content at the carrier level, whether owned or resold. The consumer-oriented “things” that comprise the IoT—including wearables, connected cars, smart homes and the government and enterprise-connected “things” such as smart businesses and smart cities (e.g., parking, city lighting, asset monitoring and tracking, and video security)—are likely areas of growth in the coming years. Consumer demand for digital technologies that make it easier to control their homes and cars has grown, and will help to drive incremental revenue in the ecosystem.

There also remains significant opportunity for mergers and acquisitions (M&A), and on the heels of some substantive announcements in 2016, 2017 is likely to be another big year for deals. One thing that may help push some deals across the finish line is the prospect of less regulation from government agencies. While the specifics of the new administration are yet to be determined, early indications are that anything is fair game for re-evaluation.

The global enterprise networking market size was USD 40.06 billion in 2015. Increasing need for enterprises to become digital to remain competitive is expected to increase the impetus for agile networking and increase the value and importance of virtual and software-defined networking. Companies are focusing on upgrading their networks to increase wireless capacity. Moreover, they are spending money to modernize their system, which is expected to fuel enterprise network demand over the forecast period.

The industry is anticipated to witness growth owing to ongoing technological innovations in wireless LAN technology and high-speed Ethernet switches. This technology is leading to the development of smaller and efficient chipsets and modules with added functions. Escalating needs for implementation of high-speed Ethernet switches are expected to provide new growth avenues over the next eight years.

Organizations are overhauling their networks with a focus on improving efficiency and responsiveness of business, enabling mobile productivity and leveraging big data.

Increasing shift towards wireless adoption, expanding the mobile workforce, rising bandwidth requirements and growing base of mobile internet devices are the key factors which are expected to drive demand. Growing adoption of virtualization technology and high demand for internet-enabled devices is expected to also contribute efficiently to industry growth.

The market is migrating from a single-vendor environment to the one in which discrete decisions for different network building blocks are rapidly becoming the norm. For network architects, is a new approach which is expected to lead to network solutions, meeting business requirements and saving money, without adding operational complexity?

Being a lucrative industry for electronic devices such as routers and switches, as well as a promising regional sector for industrial manufacturing, the Asia Pacific enterprise networking market contributed to over 35 percent of the global revenue in 2015 and expected to grow the same till 2020. Outsourcing of manufacturing activities to low-cost developing countries in Asia is expected to witness strong demand for high-quality precision equipment in this region. Robust development of IT sector and tremendous appetite for technologically advanced devices in the Chinese market are expected to boost regional growth over the next seven years. Networking is the dark knight of IT sector which will grow as we grow.

CIO Viewpoint

Cloud is no more a Buzz Word. It is Here to Stay!!

By Mosesraj R, AVR – IT & Excellence, Brillio

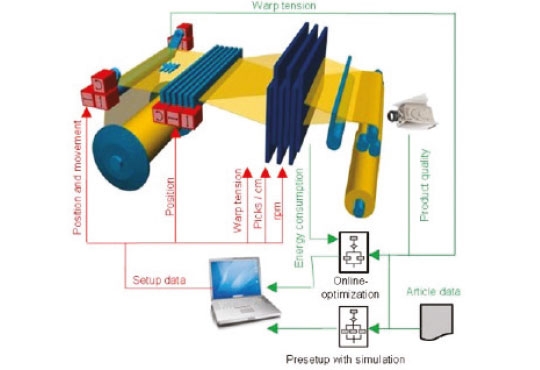

Importance of Technology in Textile...

By Kunal Mehta, General Manager – IT, Raymond Limited

Role of IoT and Digital technology in Textile...

By Abdulla Fatiya, Head IT SAP Applications, D'Decor Exports

CXO Insights

Giving the Customer Full Control to Improve...

By Anand Natarajan, Head of Strategy and Business Execution, Fullerton India Credit Company Ltd

Addressing the Transformations in Networking...

By Manoj Chugh, President - Enterprise Business, Tech Mahindra

Creating Competitive Advantage Through...

.jpg)